We provide repayment plans that adjust to your evolving circumstances, competitive rates that save you money, and fast loan approvals to help you move forward quickly.

We provide repayment plans that adjust to your evolving circumstances, competitive rates that save you money, and fast loan approvals to help you move forward quickly.

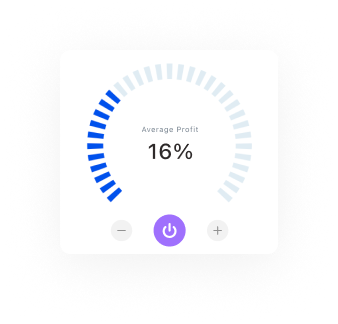

Ssimple, user-friendly loan application form with secure encryption ensures quick submissions. Users can upload required documents and track their application progress in real-time.

Our Automated loan eligibility checks based on user input provide instant feedback. This feature helps applicants understand their chances of approval before completing the full application.

Commercial loans up to $200M. Rates starting at 5.99%. Terms up to 120 months.

We can help you with loans to purchase property or refinance properties you own.

Minimum loan amount: $5 Million with up to $250 Million Maximum. Rates start at 4.5%.

Our minimum loan amount is $200,000 and the upper limit to $5, 000, 000. Both depend on borrower’s capacity to repay based on verifiable income level and other selection criteria.

Land Loans provide financing for the purchase of land, whether for residential, agricultural, or commercial use. They offer flexible repayment terms and are tailored to meet your specific property needs.

Bridge Loans provide short-term financing for property purchases or investments, offering flexibility until long-term funding is secured. They are ideal for real estate investors or businesses needing immediate capital.

Absolutely! Debt Consolidation Loans allow you to combine multiple debts into one loan with a single monthly payment, often at a lower interest rate, simplifying your finances.

The loan application process is simple: select your loan type, fill out the online form with your details, and submit it. Our team will review and get back to you promptly with the next steps.